Where did flow go?

Over the last 7 years I have had the opportunity to work with dozens of insurance brokers across Canada. One of the most frequently asked questions I get regardless of where I am (province) or what BMS is being used is ‘can you help us build a standard workflow?’

The answer is yes… most of the time.

Standard workflows are great – they generate all kinds of wonderful benefits.

- They give us standardized coding – this leads to reports that actually make sense; ones that management can actually use and have confidence in.

- They act as a training tool. Fantastic when a new hire arrives – starts them off on the right foot!

- They offer transparency AND transferability. If someone isn’t at their desk when a client calls, at least we’ll know where to find information.

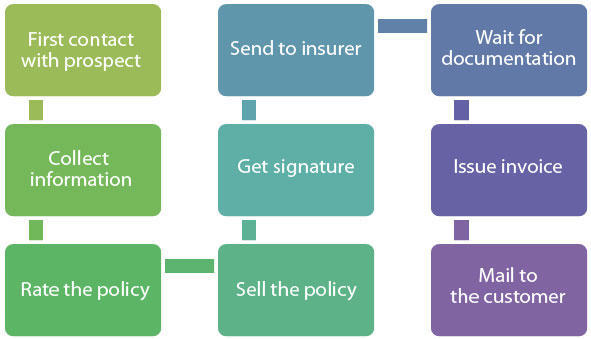

They SHOULD look like this:

But they often look like this:

The biggest challenge is that standard workflows are VERY difficult to define, especially in the current Canadian P&C industry. Why is this? Too many choices, too many options, TOO MUCH VARIETY!

As soon as we have two of anything, we have variety. And variety kills the flow in a workflow.

And we have a lot of variety in our industry:

- Multiple technologies (Broker management systems, voice recording systems, policy management systems, rating tools, versions of Outlook) with integration “challenges”

- Multiple insurance company contracts

- Multiple product offerings

- Multiple options and endorsements available EACH with its own set of underwriting criteria, rates and conditions

- Multiple carrier portals

- Multiple optimal methods of communication (phone, email, portal and yes, fax)

So can we build a standard workflow when nothing is standard to begin with?

Next blog: Getting our flow back!

Efficiency

Modern workflows help you grow.

Learn more

Strategy

Plan your work and work your plan.

Learn more